Employee Benefits 2020: Why Employees Want Financial Wellness

In their annual survey on employee benefits, the Society for Human Resource Management (SHRM) discovered that financial wellness is one of the top benefits most employees want in 2020.

Employee Benefits 2020: Why Employees Want Financial Wellness

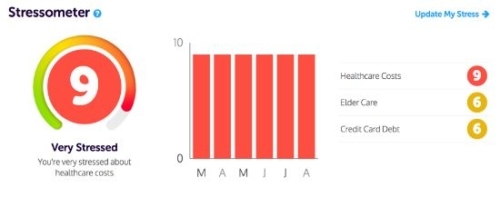

Why do employees want financial wellness? Well, they’re financially stressed. Seriously stressed. A Mercer study from 2017 found that employees spend an average of 3 to 5 work hours per week working on issues related to personal finance.

From an employer’s perspective, providing overall financial wellness tools and resources as an employee benefit would have been unheard of a generation ago. But today, 78% of Americans live paycheck to paycheck, and financial stress has permeated all corners of the workforce.

There are four generations of employees in the workplace (Gen-Z, Millennials, Gen-X and Baby Boomers), and all are dealing with most of the same financial issues. But, they experience that financial stress in different ways. That’s why providing the right mix of financial wellness tools and resources that can provide personalized and contextual assistance is table stakes.

How Financial Stress Affects Your Employees

Here’s a quick look at the four generations and some of the financial issues they’re struggling to manage:

Gen-Z: They’re dealing with high student loans and credit issues due to late payments on bills. Nearly a third are worrying about paying for housing (renting, not owning) and 28% worry about hunger. Overall, there’s a lot of general money angst.

Millennials: This generation is $1 trillion in debt, which is more debt than any generation in history. Student loans make up the majority of that debt. A third have a credit score that is subprime or lower. The average age for buying a first home is 34, the highest in history and this cohort owns fewer homes than previous generations. Childcare can cost up to 50% of their income, and more than half are getting some sort of financial help from their parents.

Gen-X: This generation has the most credit card debt of any demographic. They’re in their peak earning years, but it’s also the peak debt years – and they’re caring for children and their aging parents (25% provide financial support to their parents) all at the same time. They’re saving for college tuition or paying their parental contribution, or just providing financial support (nearly 50%) to their adult children. That’s why they’re so retirement un-ready: One third has no retirement savings at all.

Baby Boomers: Their financial stress centers around longevity – theirs. Baby Boomers are living longer and since they don’t have much in the way of retirement savings, they’re staying in the workforce longer, too. They worry about paying for their grandchildren’s college educations and their own healthcare costs in retirement. They need to work, but they want some flexibility, too.

More on Employee Benefits Trends and Financial Wellness

5 Must-Have Benefits for Millennial Employees

How Does Financial Wellness Affect Health?

5 Fast Financial Stress Statistics

Hiring Trends to Watch in 2020

What Is Financial Literacy and Why Is It Important?

4 Big Employee Benefit Trends for Family Planning