U.S. Rent’s on the Rise: How to Fight Housing Insecurity for All Employees

Whether you’re buying or renting, housing is less affordable today than it was a year ago. Rental prices have risen 15%, according to Redfin data, and the Federal Reserve recently announced another interest rate hike, which will raise the cost of mortgages. As a result, more people are facing housing insecurity.

Increasing housing costs affect everyone from minimum wage employees to six-figure executives. Learn more about how housing insecurity may be hurting your workforce and how to support secure housing for all.

What is housing insecurity?

Housing insecurity is an umbrella term for the different housing-related problems people have (including, but not limited to affordability, safety, quality and security).

Housing insecurity may look different from person to person. Today, over 3.5 million people suffer from housing insecurity, according to the National Alliance to End Homelessness, which covers a broad spectrum of issues and situations.

3 ways companies can fight housing insecurity for all:

Housing insecurity affects most workforces across America and with rents still rising, even more people may become impacted. Luckily, companies can help all employees build a future of financial wellness and housing security in three key ways:

1. Provide financial wellness and budgeting tools.

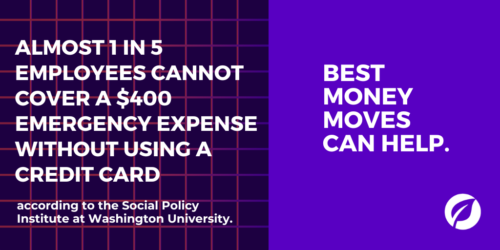

Although low-wage employees have been disproportionately affected by rent hikes, employees across the income ladder have been impacted, too. By investing in robust financial wellness resources, companies can help ensure housing security for all employees.

Money coaching, budgeting tools and other financial advice can help employees navigate new rent hikes and adjust their budget, regardless of an employee’s living situation or income level. Financial wellness resources are to people reach their most personal financial goals, whether it’s homeownership or simply making ends meet.

2. Allow remote/hybrid work to stay.

Across America, living in the city or business districts tends to be more expensive than surrounding cities or suburbs. With remote and hybrid work, employees are given newfound flexibility in how they make housing decisions.

By preserving remote and hybrid work models, companies can help employees work toward sustainable housing situations that they can afford long term. Instead of prioritizing being close to the office or city center, employees can prioritize affordability and security when choosing where to live. Moreover, remote and hybrid work models help employees save money by commuting less.

3. Offer relocation benefits.

Moving can be costly, especially when moving out of state for a new job. For instance, in the Chicago, Ill. metro area, the median asking rent is $2454 per month, according to Redfin data, and $4000 in the Boston and New York metro areas.

To help reduce the financial burden of moving and housing, some leading companies have invested in relocation support for employees (e.g., company-sponsored moving services, subsidies or even temporary corporate housing). By offering relocation benefits, companies can support housing security for all employees, while themselves apart from the competition.

Financial wellness is an investment, but it doesn’t have to be costly. Need a top-notch, budget-friendly solution? Try Best Money Moves!

Best Money Moves is a financial wellness solution designed to help dial down employees’ most top-of-mind financial stresses. As a comprehensive financial well-being solution, Best Money Moves offers 1:1 money coaching, budgeting tools and other resources to improve employee financial wellbeing. Our AI platform, with a human-centered design, is easy to use and fit for employees of any age.

Whether it be college planning or securing a mortgage, Best Money Moves can guide employees through the most difficult financial times and topics. Our dedicated resources, partner offerings and 700+ article library make Best Money Moves a leading benefit in bettering employee financial wellness.

To learn more about Best Money Moves Financial Wellness Platform, let’s schedule a call. Contact us and we’ll reach out to you soon.