Most Americans Live Paycheck-To-Paycheck. Here’s How Employers Can Help

Inflation has caused food, gas and housing prices to skyrocket. Between May 2021 and May 2022, inflation hit 8.6% — the highest increase since December 1981, according to the Bureau of Labor Statistics — and economists are unsure when prices may fall.

Trying to make ends meet, about 60% Americans are living paycheck-to-paycheck, according to a LendingClub report, making it the primary financial lifestyle in the U.S.

Living check-to-check isn’t sustainable — it leaves people susceptible to increased debt and high-stress levels. Here are 4 ways companies can help employees manage rising inflation and create viable money habits for the future.

1. Offer budgeting tools and 1:1 money coaching to help employees living paycheck-to-paycheck.

Even with a high income, poor budgeting or not budgeting at all can create a paycheck-to-paycheck lifestyle. For instance, although 7 in 10 Americans have a budget, only 25% have detailed budget, according to a TIAA report. Without a detailed budget, it is difficult to accurately keep track of how much money is coming in and going out each month.

To help employees break with a paycheck-to-paycheck lifestyle, companies can offer budgeting tools and personalized money coaching. These resources are to help employees focus on necessitates and better allocate their money, regardless of their income level. Moreover, it can help identify savings gaps or where to cut down spending.

2. Provide student loan repayment assistance.

Since the federal student loan pause started in 2020, repayment has not been top-of-mind for most Americans. However, this is expected to change starting August 31, 2022 — when student loan repayment, interest and collections pause is scheduled to expire. This means millions of Americans will have to reintegrate student loan payments into their monthly budget, but with rising inflation, many are worried if they can afford to resume payment.

By providing student loan repayment assistance, firms can demonstrate a commitment to employee financial wellness and wellbeing. Not only will this help employees lower their student loan debt, but it will also help them weather inflation and financial stress.

3. Invest in mental health resources for those living paycheck-to-paycheck.

Money stress does not function in a vacuum — it can bring on emotional stress, physical stress and even wear down someone’s mental health. According to TIAA, 59% of Americans carry financial stress and with prices on the rise, this number may grow.

To help dial down stress levels and support all-around employee wellbeing, firms are investing mental health resources like talk therapy and meditation apps. Consider ways your company can make mental health resources more affordable and accessible for employees at all paygrades.

4. Expand financial literacy and education opportunities.

With the right tools and resources, companies can help employees strengthen their financial wellbeing and knowledge, simultaneously. At every budget, there are ways institute financial wellness programming and resources, whether it be tax filing workshops or retirement planning seminars.

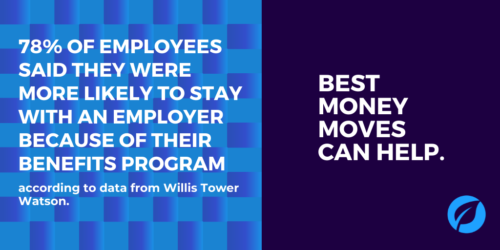

Companies are most successful when they listen to the wants and needs of their own employees, then creatively follow through in their financial wellness offerings and approach. When searching for a quality financial wellness program, try to avoid one-size-fits-all solutions and keep an eye out for customized services (e.g., 1:1 money coaching, mortgage and loan calculators and other personalized solutions).

Need a top-notch, budget-friendly financial wellness program? Try Best Money Moves!

Best Money Moves is a mobile-first financial wellness solution designed to help employees dial down their financial stress and meet their most top-of-mind financial goals. With budgeting tools and personalized money coaching, users can easily receive compressive financial advice right from their phones.

Best Money Moves is designed to guide employees through the most difficult financial times and topics. Our dedicated resources, partner offerings and 700+ article library make Best Money Moves a leading benefit in bettering employee financial wellness.

To learn more about Best Money Moves Financial Wellness Platform, let’s schedule a call. Contact us and we’ll reach out to you soon.