Holistic Wellness: 4 Benefits for a Better Plan

Holistic wellness is gaining traction as companies recognize the value of supporting employees across multiple dimensions of well-being.

A holistic wellness plan extends beyond traditional benefits. It focuses on a comprehensive approach to the physical, mental, financial and social aspects of an employee’s life. It aims to create a healthier, more engaged workforce by addressing employees’ evolving needs.

However, many employees feel their current benefits don’t meet their day-to-day needs, according to a 2024 Wellbeing and Voluntary Benefits Survey from HR consulting Firm Buck. Only 40% believe their company effectively supports their overall well-being and another 63% of employees said they would consider switching jobs for better benefits.

A thoroughly considered, holistic benefits plan may be the missing link to filling these gaps. The right holistic benefits not only help employers attract and retain talent but also foster a more productive and engaged workforce.

4 Holistic Benefits For A Better Plan

When employees face health challenges, the resulting stress impacts their well-being, performance, engagement and job satisfaction. A holistic wellness plan can address these diverse challenges, improving workplace culture, encouraging engagement and boosting productivity.

A successful holistic wellness plan should integrate benefits that cater to various facets of employees’ well-being. Here are four core areas to consider:

1. Mental Wellness

Mental health is increasingly recognized as a critical component of employee well-being. McKinsey reports that nearly 60% of employees face daily mental health challenges, directly affecting their work performance.

To address this, companies can offer mindfulness programs that help employees manage stress and improve focus. Peer-to-peer counseling and healthcare access also create support networks within the workplace, offering employees a safe space to connect and seek help. Companies have also turned to volunteer initiatives, shown to improve mental health by providing a sense of purpose, boosting happiness and increasing productivity. By providing stress management workshops and coaching apps, companies can provide employees with resources to handle stress at their own pace.

2. Physical Wellness

Supporting employees’ physical health can significantly enhance productivity and reduce workplace stress. Exercise programs and nutritional challenges are commonly used to encourage employee health. These programs have been shown to lead to healthier food choices and have been linked to reductions in stress, anxiety and depression. Companies can also incorporate sleep education into their wellness programs. Nearly 75% of employees get less than the recommended seven hours of sleep per night, according to data from Glassdoor. By promoting physical health, companies can contribute to better mental well-being, energy levels and focus.

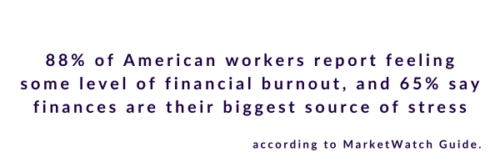

3. Financial Wellness

Financial stress is a significant burden for many employees. Recent data from Bank of America reveals around 26% of U.S. households report living paycheck-to-paycheck. Financial wellness programs can help ease these concerns and provide long-term security for employees.

Financial coaching and savings programs can help employees better manage their current finances while also planning for the future, helping to reduce day-to-day financial stress. Programs like auto enrollment into 401(k) plans, starting with an 8-10% contribution rate and auto-escalating annually can start employees on a secure path toward retirement saving. Offering benefits such as tuition reimbursement and life insurance subsidies can be especially helpful for working parents. With a multigenerational workforce, it is ever-important to tailor financial wellness programs to the needs of employees at various life stages.

4. Social Wellness

Social connection in the workplace is more important than ever, especially with the rise of remote and hybrid work environments. According to Harvard Business Review, employees with a strong sense of community at work are nearly 60% more likely to thrive in their roles. Maintaining employees’ social wellness is a crucial aspect of maintaining holistic wellness. Even remotely, team-building activities, company-wide events and peer challenges can help employees build camaraderie and strengthen relationships with one another. Recognizing employees’ accomplishments and celebrating milestones in peer shout-outs also creates a sense of belonging and motivation in the workplace. Even in virtual settings, promoting social interaction can help employers create a positive and inclusive workplace culture.

A holistic wellness plan offers employees much-needed support in various areas of their lives — mental, physical, financial and social. By implementing such a plan, companies can not only boost productivity and engagement but also attract and retain top talent in today’s competitive job market.

Round out your holistic benefits plan with financial wellness from Best Money Moves.

Best Money Moves is an AI-driven, mobile-first financial wellness solution designed to help employees with varying levels of financial knowledge dial down their most top-of-mind financial stresses. As an easy-to-use financial well-being solution, Best Money Moves offers comprehensive support toward any money-related goal, ranging from debt management to purchasing a home. With 1:1 money coaching, budgeting tools and other resources, our AI-driven platform is designed to help bolster employee financial wellbeing.

To learn more about Best Money Moves Financial Wellness Platform, let’s schedule a call. Contact us and we’ll reach out to you soon.