Simple Ways to Improve Company Culture For Hybrid Work

Simple Ways to Improve Company Culture For Hybrid Work. Hybrid work options have become one of the most in-demand employee benefits. Here are five ways to improve your company culture for hybrid employees.

Hybrid work options have become one of the most in-demand employee benefits with research from Stanford University suggesting that employees perceive hybrid work as equivalent to an 8% pay increase.

Employees in hybrid positions benefit from increased flexibility, improved work-life balance and significant savings on commute costs. Data from Upwork also suggests that around one-third of the total American workforce will be hybrid or remote by 2025.

However, transitioning a team to a hybrid work model can pose challenges regarding company culture. A strong company culture fosters a sense of belonging among employees, which is crucial for their performance, engagement and well-being. Studies indicate that employees who feel connected to a larger organization tend to perform better and experience greater satisfaction in their work.

Hybrid and remote workers, who spend time away from their coworkers and physical office space, may not experience the same level of connection and company culture. Hybrid workers often run the risk of isolation and miscommunication. They may also have more difficulty collaborating with their coworkers than those who work from a central location.

As employees seek more workplace flexibility, organizations must adapt and find ways to help their company culture transcend physical office space. These five strategies can help nurture a thriving company culture in this new hybrid era.

1. Set expectations for remote versus in-person work.

Both in-person and hybrid work models offer unique benefits. In-person work, for example, serves as a vital platform for collaboration and team bonding. There is often more opportunity to develop a sense of company culture when you see your coworkers every day. Remote employees, on the other hand, may feel more isolated from their peers. However, they also enjoy a more flexible schedule and may benefit from the ability to work fewer in-office distractions.

Rather than force the same expectations on remote and in-person workers, employers should embrace the differences and emphasize the workflow expected from in-person versus remote work days. Moreover, it’s vital to establish clear expectations and shared goals. This includes defining subjective terms such as appropriate response times, frequency of check-ins, preferred communication platforms, and when to use video conferencing versus messaging options.

2. Enhance communication and feedback opportunities.

One integral aspect of in-person work is the informal socialization that employees enjoy throughout the workday. Casual conversation helps foster organic relationships among team members.

It may benefit remote teams to reintroduce this element of socialization via video chats and other communications. A study by Canon specifically found that video plays a fundamental role in communication among hybrid teams.

Eight in 10 people who turned on their cameras during virtual meetings felt more productive when others had their cameras on as well. Participants also reported that being able to share documents, images and videos during meetings (66%) and being able to see the other meeting attendees (58%) helped them interact with their colleagues better.

Additionally, informal gatherings like virtual coffee chats can strengthen bonds among hybrid employees. Digital water coolers, virtual lunches or informal coffee chats are additional strategies to foster camaraderie. Regular weekly staff meetings and comprehensive email updates help hybrid workers stay synchronized with the team and minimize feelings of isolation.

3. Promote equitable collaboration and hybrid meeting protocols.

It’s crucial to set clear communication protocols, both when in-person and working remotely. Online messaging tends to increase during hybrid work, so explicitly outlining when an email reply is necessary streamlines communication and prevents inbox overload for both employees and employers. Additionally, distinguishing between tasks that require in-person collaboration and those suitable for hybrid work is essential.

With the rise of hybrid work, team members now frequently join meetings from different physical spaces. Employers can ensure equitable participation by mandating that all team members log in using their own devices even when in the office promotes inclusivity of all meeting attendees.

Alternatively, if individual devices are not feasible, establish processes that guarantee all employees remain included in discussions. This might include not discussing group matters after remote participants have left a meeting.

3. Recognize and promote employee contributions within your community.

Fostering a team mindset becomes increasingly vital when team members are not physically together. During in-person work, this is easily done through peer shoutouts during meetings. Employee promotion can be similarly achieved remotely by way of positive feedback and recognition of employees’ contributions through virtual means.

Employers can cultivate an atmosphere of appreciation by sending regular email updates about team achievements and praising their employees during virtual staff meetings either through chat boxes or by unmuting on calls, ensuring that both in-person and hybrid employees are included.

It is also important to make sure that hybrid employees are not excluded from workplace activities that would ordinarily take place in person. Virtual birthday cards or other celebrations help ensure everyone feels valued and included, regardless of location.

Mentorship programs provide yet another straightforward approach to connecting employees. Whether conducted in person or through online platforms, these programs facilitate collaboration and knowledge-sharing among employees at different levels within the organization.’

Ultimately, even employees who are not physically together can still form meaningful relationships with their coworkers and feel deeply connected to their organization. Keep your lines of communication clear and open to change. Consider offering employee surveys to collect continuous feedback and ensure employees’ voices are heard even when they’re not in the office and help your transition to hybrid work happen as smoothly as possible.

Support your hybrid workforce with Best Money Moves!

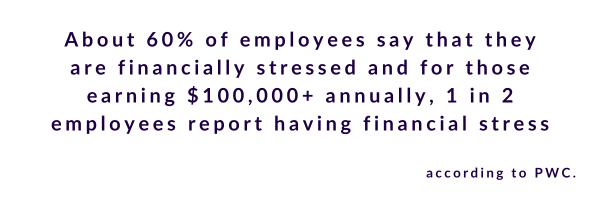

Best Money Moves is a mobile-first financial wellness solution designed to help dial down employees’ most top-of-mind financial stresses. As an easy-to-use financial well-being solution, Best Money Moves offers comprehensive support toward any money-related goal. With 1:1 money coaching, budgeting tools and other resources, our AI platform is designed to help improve employee financial well-being.

Whether it be retirement planning or securing a mortgage, Best Money Moves can guide employees through the most difficult financial times and topics. We have robust benefits options for employers, regardless of their benefits budget.

Our dedicated resources, partner offerings and 1000+ article library make Best Money Moves a leading benefit in bettering employee financial wellness.

To learn more about Best Money Moves Financial Wellness Platform, let’s schedule a call. Contact us and we’ll reach out to you soon.