3 Ways to Prepare Your Employees for a 2023 Recession

Economists say there is a 60/40 chance that the US will face a recession in 2023, according to a survey conducted by the Wall Street Journal. This news follows a year where significant inflation and climbing interest rates challenged employee financial confidence.

Employers need to equip their staff with the right resources if they hope to remain productive amid a large scale financial downturn. Here are three ways to prepare your employees for a 2023 recession.

1. Address the challenges of a 2023 recession head-on with accessible financial wellness tools.

Financial wellness tools are always a good investment for you team, but they’re never more important than during periods of economic upheaval. Over 62% of employees are stressed about their finances, according to The Bank of America 12th Annual Workplace Benefits Report. What’s more, 80% of employees worry about inflation and 71% of those feel that their wages are not on track to keep up with the cost of living.

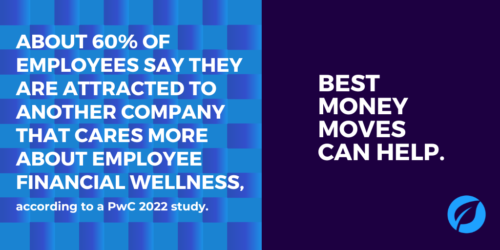

With a 2023 recession on the horizon, it’s time to address employee financial needs head-on. In the same Bank of America study, research found a significant link between employer involvement in financial wellness and employee attrition. A whopping ninety-seven percent of employers report feeling responsible for their employee’s financial wellness. What’s more, 84% of employers felt that offering financial wellness tools helped with retention. With this in mind, it’s hardly a surprise that financial wellness is shaping up to be one of the top benefits of 2023.

2. Invest in benefits with a DEI edge.

Research suggests that workplaces who prioritize diversity, equity and inclusion efforts tend to fare better during times of upheaval. Data collected by AARP international and Great Place to Work, found that diverse organizations performed nearly four times better than their competitors who employed less diverse teams, during the 2008 recession.

Financial wellness solutions are a key benefit when thinking about DEI. All employees, regardless of their backgrounds, have to deal with financial matters in some capacity. Moreover, minority employees often find themselves the most in need of financial wellness support. White families have an average eight times the wealth of black families, and five times the wealth of hispanic families, according to 2020 research from the federal reserve. Female employees are also disproportionately affected by financial stress compared to their male colleagues. Data from the Financial Health Network found that the pandemic only served to widen this gap.

Addressing these disparities among your team starts with making sure everyone has access to the same financial tools, resources and education to address their individual needs. Financial solutions can can also be a great way to retain and attract new, diverse talent as 4 out of 5 employees said they would prefer benefits over a pay increase, per Human Resources Director.

3. Promote work-life balance and build trust in your team — wherever they work.

If employees are to face a 2023 recession, work-life support from employers will become more important than ever. A 2021 survey conducted by Ernst & Young Global recorded that 54% of respondents worldwide said they might leave their jobs without flexibility in the post-pandemic era. And the reason why often comes down to a matter of money.

For many families, tough financial times means making hard decisions about inflexible expenses like health or childcare. Juggling personal responsibilities is a big part of employees’ budgeting: for some working parents, a recession could mean determining if they can afford to keep sending a child to daycare during the workweek.

Knowing that their companies trust them to do their jobs well remotely can have a huge impact on employee retention and attracting new employees. When surveyed by Harris Poll, seventy-six percent of workers cited a desire for their employers to implement remote work some or all of the time.

Be prepared for a 2023 recession with financial wellness tools from Best Money Moves.

Best Money Moves is a mobile-first financial wellness solution designed to help dial down employees’ most top-of-mind financial stresses. As a comprehensive financial well-being solution, Best Money Moves offers 1:1 money coaching, budgeting tools and other resources to improve employee financial wellbeing. Our AI platform, with a human-centered design, is easy to use and fit for employees of any age, right from their mobile phones.

Whether it be college planning or securing a mortgage, Best Money Moves can guide employees through the most difficult financial times and topics. Our dedicated resources, partner offerings and 700+ article library make Best Money Moves a leading benefit in bettering employee financial wellness.

To learn more about Best Money Moves Financial Wellness Platform, let’s schedule a call. Contact us and we’ll reach out to you soon.