How Fintech Is Driving the Push for Better Employee Benefits

Companies have primarily adopted fintech for customer or client-facing use cases (such as, accepting ApplePay or GooglePay). However, even more are missing out on the employee-facing benefits of this evolving technology.

Learn how leading employers leverage the power of fintech to transform their benefits offerings and retain the job market’s best talent.

So, what is fintech?

Broadly, fintech, or “financial technology,” is any technology used to spend or manage money. Often, fintech comes in the form of a phone app or website. It may allow people to perform money-related tasks within seconds.

Everyday examples of fintech include:

- Using a budgeting app

- Sending money to a friend digitally

- Making purchases via tap-to-pay (e.g., Apple Pay or GooglePay)

More recently, fintech has entered the landscape of employee benefits and compensation. Financial wellness is top of mind for employees and employers. Investing in fintech solution can help simplify benefits and support employee well-being.

How fintech is transforming the employee benefits space

Here are some of the fintech benefits companies have adopted to empower their employees’ financial wellness:

- AI-driven budgeting tools

Most Americans (84%) have found that despite having a monthly budget, they sometimes overspend, according to NerdWallet’s Consumer Budgeting survey. Overspending can lead to a cycle of debt that can quickly compound overtime. AI-driven budgeting tools can analyze employees’ spending habits and deliver personalized solutions. For example, for employees who may have challenges with overspending, AI budgeting tools can streamline expenses. These tools deliver real-time budget updates, and generate recommendations on where to dial down expenses.

- Earned wage access & other alternative payment methods

As fintech continues to innovate, companies are rethinking how employees are compensated. Some companies have adopted is earned wage access, which allow employees to access their paycheck early, while avoiding predatory payday loans. According to a study conducted by ADP, most employees (76%) are interested in earned wage access. This is true regardless of age, education and income levels. By investing in earned wage access, companies can empower employees with increased financial flexibility.

- Mobile-first financial wellness education

Mobile-first financial education makes it easy for employees to learn about financial wellness, all from their smartphone. And when equipped with the right tools, employees are empowered to make well-informed financial decisions for their short-term and long-term well-being. For instance, learning about different types of retirement accounts beyond a 401(k) can help employees decide which is best for them. In addition, learning about how to shop for a credit card can help employees avoid predatory interest rates. Financial education can help employees dial down their financial stress and, in turn, improve their overall well-being.

Advantages of investing in fintech employee benefits:

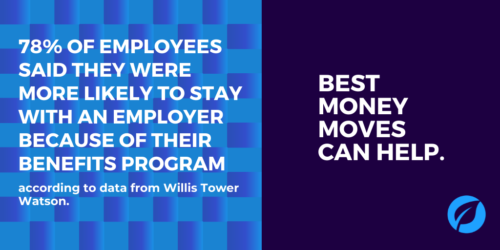

- Reduced attrition rates

According to a Bank of America study, over 80% of employers say that offering financial wellness benefits helps improve employee retention rates. Top talent wants more than a high-paying salary. They want an employer who is invested in their overall well-being, including their financial health.

- Increased personalization of financial wellness benefits

AI and machine learning have made it easier for companies to provide bespoke financial wellness benefits at a reasonable cost. This allows employees to get more individualized support, rather than cookie-cutter financial advice.

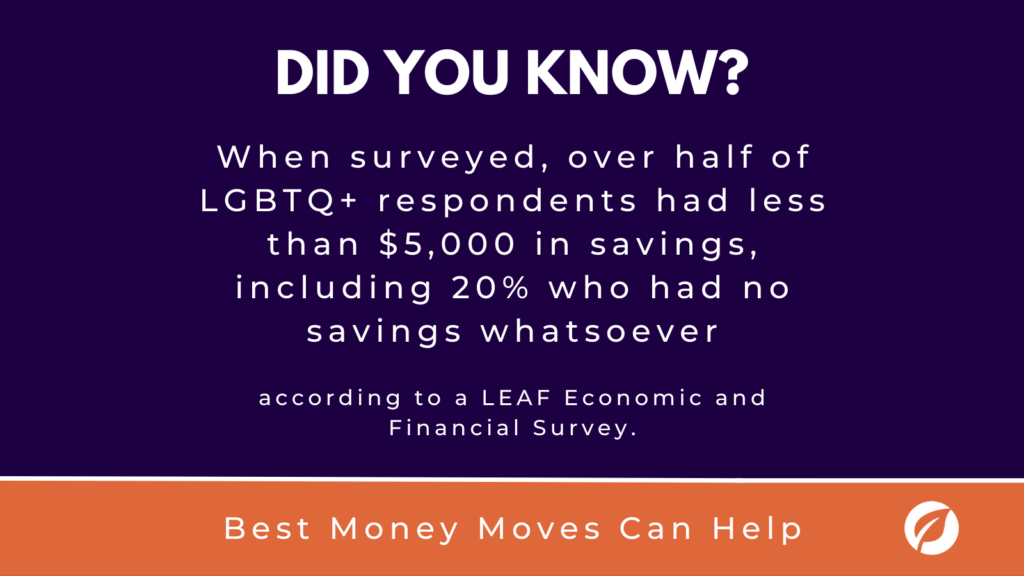

- Improved accessibility of financial services

Historically, access to financial services was limited to wealthy individuals. However the innovation of fintech had made financial services increasingly accessible. Adopting fintech employee benefits can help employees across the income ladder. These might include personalized financial resources, such as 1:1 financial advising.

Looking for a fintech solution to support your employees? Try Best Money Moves!

Best Money Moves is an AI-driven, mobile-first financial wellness solution. BMM is designed to help employees with varying experience dial down their financial stresses. Best Money Moves offers comprehensive support toward any money-related goal.

Our dedicated resources, partner offerings and 1000+ article library make Best Money Moves a leading benefit in bettering employee financial wellness. To learn more, contact us at customersupport@bestmoneymoves.com and we’ll reach out to you to schedule a call!