Employee Caregivers Need Support. This Is How to Offer It

Research from Harvard Business Review reveals more than 70% of employees are caregivers in some capacity. Caregiving encompasses everything from basic childcare to supporting elderly family members.

And this silent majority desperately needs support. Along with their responsibilities at work, these employee caregivers spend between 20 to 30 hours addressing the needs of their loved ones. The costs associated with caregiving practices can also add to these employees’ financial stress, which can affect their mental health and performance on the job.

Here are the three top ways to leverage your benefits to help your employees with their caregiving needs.

1. Communicate with employee caregivers to help inform your benefits decisions

The best way to understand what your employee caregivers need is simple — ask them directly. Using surveys and in-person conversations, get a sense of what your workforce struggles with to better inform how to shape your benefits package. It can also be beneficial to conduct competitor research to see how other companies handle benefits.

Paired with collecting data is creating a culture where caregivers are supported. Ensure your employees are familiar with all of the resources available to them. Orientation and onboarding are great ways to start the conversation, while monthly emails and flyers help continue it. Employee caregivers who don’t use their benefits might be unaware or intimidated by how complex they can be.

2. Flexible benefits are key to supporting caregivers

No strategy can be one size fits all because caregivers’ needs vary widely. To best support all of your employees, consider including flexible benefits in your compensation package. These benefits include shared time off, PTO, unlimited vacation and remote or hybrid work. Flexible work schedules allow employees to balance their work and life responsibilities more effectively while limiting stress and burnout. According to AARP, 84% of employee caregivers find flexible schedules “very helpful.”

To go above and beyond for your workforce, you may also want to provide caregiver-specific benefits.

These include but are not limited to:

- Basic caregiver education

- Support groups

- Employee Assistance Programs (EAPs)

- Information about government resources

All of these programs provide necessary support to caregivers that may not be readily available. Government assistance, such as EAPs, have resources that include counseling, assessments and consultations, which all have their benefits for caregivers.

Not all companies have the bandwidth to support these measures, but those that put an emphasis on their caregiving employees can help that much more. And when employees see their workplaces care for their needs, they are more likely to stay engaged and productive.

3. Offer financial wellness tools to ease the burden of caregivers

Balancing the responsibilities of life and a full-time job can be difficult, but the financial strain it puts on employees can be crippling. No matter what the caregiving entails, there are likely significant costs associated.

Costs include but are not limited to:

- Transportation

- Medical equipment

- Home accessibility modifications

- Housing

These costs add up quickly and put a major dent in monthly expenses. A 2024 AARP poll found that one-third of caregivers in Vermont feel financially strained by their caregiving responsibilities.

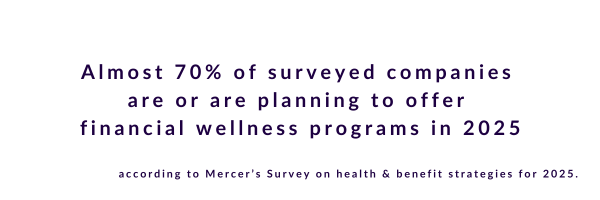

The answer to these financial concerns is a comprehensive financial wellness program. Financial wellness programs offer personalized solutions to the most common money stresses.

Educational resources, advisors and budgeting tools all come stock-standard with great wellness programs and are proven to help ease the burden of financial stress. Many wellness programs are also personalized to fit employee needs and offer support specific to their situations.

Are you looking for a financial wellness solution that supports caregivers? Try Best Money Moves!

Best Money Moves is an AI-driven, mobile-first financial wellness solution designed to help employees with varying levels of financial knowledge dial down their most top-of-mind financial stresses. As an easy-to-use financial well-being solution, Best Money Moves offers comprehensive support toward any money-related goal, ranging from debt management to purchasing a home. With 1:1 money coaching, budgeting tools and other resources, our AI-driven platform is designed to help bolster employee financial wellbeing.

To learn more about Best Money Moves Financial Wellness Platform, let’s schedule a call. Contact us and we’ll reach out to you soon.