3 Big Benefits Mistakes to Erase From Your Program

3 big benefits mistakes to erase from your program. Your employees are disappointed in their benefits. Avoid these common benefits mistakes to improve engagement and promote wellbeing at your company.

The right benefits strategy is critical to attracting and retaining talent at any company. In a recent PeopleKeep survey, 81 percent of respondents felt that an employer’s benefits package was a deciding factor when accepting a new job.

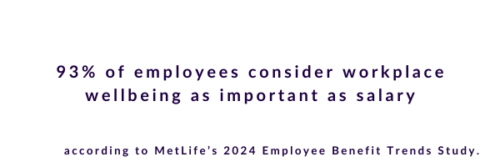

In fact, according to MetLife’s 2024 Employee Benefit Trends Study, 93 percent of employees consider workplace wellbeing as important as salary.

However, despite this importance, employers still fall short when it comes to selection — and these benefits mistakes can lead to serious consequences for your team. Forty percent of employers see workers leave their jobs for access to better benefits, according to data from Forbes Advisor. The wrong strategy can leave employees feeling undervalued and overworked, resulting in high turnover and other expensive problems.

Don’t let simple benefits mistakes derail your entire organization. Avoid these costly missteps when putting together your benefits packages.

1. Having an unclear benefits offering

A lack of understanding is the most common issue that prevents employees from accessing benefits. According to Ameritas, 85 percent of workers don’t understand their benefits options. Responsibilities at work and at home often push accessing benefits far down the list of priorities. The intricacies of plan choices and coverage options may also overwhelm employees who haven’t engaged with them before.

The solution, then, is clear. Providing educational benefits materials is key to improving engagement and making the most out of your current offering. Breaking down complex benefits into digestible steps can help employees of all backgrounds get a jumpstart on their benefits. Also, be sure to provide support and answer questions as they come up.

2. Choosing irrelevant and outdated benefits

Before considering any benefits, it’s important to understand what employees want out of their compensation package. According to PeopleKeep, the most important resources to employees include health benefits, dental insurance, paid time off and retirement options.

However, just because a resource is requested doesn’t mean it’ll be utilized. Consider the usage of each of your benefits when evaluating which ones are best for your organization.

To provide relevant benefits, it’s important to survey your workforce to understand what they are looking for. In the same PeopleKeep survey, only 47% of respondents claimed that the benefits their employers offered fit their specific needs. As a result, personalization is another major aspect of benefits that goes unnoticed. According to Benefit Hub, 75% of employees want custom support based on their mental, physical and financial needs.

3. Overlooking employee financial security

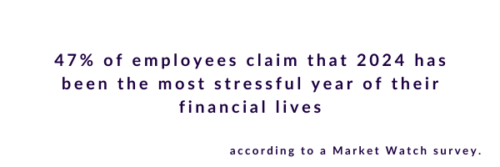

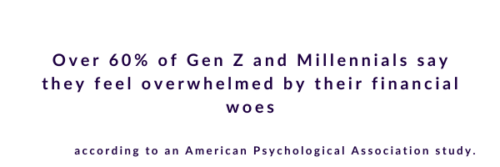

Financial stress is one of the top issues affecting Americans and may be taking its toll on your employees. According to CNBC, nearly 60% of Americans live paycheck-to-paycheck. And this financial stress comes at a cost. In a 2024 SoFi survey, 1 in 4 employees claimed that this financial stress was detrimental to their workplace performance.

According to MetLife’s 2024 Employee Benefits Trend survey, 45 percent of employees reported that financial stress was the top cause of their poor mental health.

The key to financial stress is a holistic financial wellness program. And employees have taken notice. A 2023 Transamerica Institute report found that 77% of employees want a financial wellness program, but only 28% of employers provide it.

Financial wellness provides clarity when making big decisions and hitting important financial milestones. With educational resources and tools, your workforce can rest assured that their most pressing financial questions are answered.

Best Money Moves is a mobile-first financial wellness solution designed to help dial down employees’ most top-of-mind financial stresses. As an easy-to-use financial well-being solution, Best Money Moves offers comprehensive support toward any money-related goal. With 1:1 money coaching, budgeting tools and other resources, our AI platform is designed to help improve employee financial well-being.

Whether it be retirement planning or securing a mortgage, Best Money Moves can guide employees through the most difficult financial times and topics. We have robust benefits options for employers, regardless of their benefits budget.

Our dedicated resources, partner offerings and 1000+ article library make Best Money Moves a leading benefit in bettering employee financial wellness.

To learn more about Best Money Moves Financial Wellness Platform, let’s schedule a call. Contact us and we’ll reach out to you soon.